If you don’t know how to manage money, you will one day find yourself up a creek without a paddle, or in a big hole with a shovel, or drinking a mai tai but standing on quicksand. You won’t be financially healthy, you’ll be treading water or sinking. You want to be on a boat with a paddle, or a motor, or on land, building a safe haven for yourself and the people you love. You want to have money when you need it, and you never know when you’ll need it. Save some money for a rainy day and of course save some money for the sunny days. Use money to make your life better.

Here are some tips on how to have a good relationship with money.

How to Make Money

Get a job.

The easiest way to make money quickly is to get a job. Someone’s lawn needs to be mowed, someone’s hair needs to be cut, and someone’s car needs to be washed. And they will pay you to do it.

Do your job well.

If you are the best lawn mower or hair cutter or car washer, then people will pay you more or use your services more often. People don’t like bad haircuts or when people miss a spot or two while mowing the lawn or washing the car.

Become good at something that only a few people can do.

If anyone can do your job just as well as you can, then you won’t be that paid much because anyone can do it and the job will go to the person who’s willing to work for the least amount of money. That’s not a game you want to play. You want to find something that only you can do, or only a few people can do as well as you. Then you are valuable because you are rare. If there’s only one architect who can design people’s dream houses to their satisfaction, then that’s the one that they’ll hire and pay handsomely.

Work for people who can afford to pay you well.

I once received a $100 tip while working as a bartender. It was from a wealthy retired surgeon. It wasn’t any harder for me to pour his scotch than it was to pour anyone else’s but he had a $100 bill in his pocket. No one else did. If your special skill is being able to market goods in a way that increases sales by 10% for a company, then that’s worth $10 a month to someone whose business does $100 of sales a month, and it’s worth $10 million to someone whose business does $100 million of sales a month. That latter company can afford to pay you more for your special skill, so, all else equal, you should try to work for them.

Know what you’re paid for.

When you know what you’re paid for, it’s easier to stay on the right track and give more of whatever you’re being paid to give, which should result in making more money. If you open a restaurant and people flock to it, you should figure out whether it’s primarily because the food is good, the music is good, or the service is good and then play to your strengths and try to make whatever is good even better. I can tell you one thing for sure: whoever is paying you isn’t paying you to just look busy. So know what you’re paid for and do that to the best of your ability and you may become even more valuable to your employer.

You might be paid by the hour but you’re not being paid for your hour, you’re being paid for the value that you add with that hour. Think of how you buy things. When you buy a 5-hour flight to Hawaii for $500, they don’t tell you that it costs $100 an hour and that you have to buy 5 hours. You’re not buying the time it takes, you’re buying the value that it adds to your life. If the trip to Hawaii took only 1 hour and cost $500, you’d be just as willing to pay that price, and perhaps you’d even pay a little more because it got you there more quickly. Find out what it is that you’re being paid for and it might point you in the direction of ways to add more value and make more money.

Work for yourself. Start a business.

The average historical annual rate of return on an investment in the stock market is about 7%. So, on average, if you invest $100 in the stock market and wait a year, then after a year, you will have $107 instead of $100. The exciting thing about going into business for yourself is that you may find that you can get a much higher return on your investment. For example, when I started selling greeting cards as a street artist, I found that I could spend about 50 cents making a card and I could sell it for $5. That’s a return on my investment of 900%! Of course, there were other costs to consider and I couldn’t just sell as many cards as I wanted to and some days I was cold and standing outside in the rain BUT: Consider for a moment the difference between 7% of your money and 900% of your money. That’s quite a big difference. Starting a business is a good way to find something that has a better return on your investment than 7%.

Invest your money.

Once you have some money saved up, you should invest it. You should invest it because if you just leave it sitting there in cash, it will decrease in value because of inflation, which is the gradual rising of prices. Here’s an example of how inflation will eat away at your savings. In 1974, it cost 10 cents to send a letter at the post office and in 1981 it cost 20 cents to send a letter. That means if you had a dollar in your pocket in 1974, you could send 10 letters but if you saved that dollar and didn’t invest it in something that outpaced inflation, then 7 years later you would be able to send only 5 letters with your dollar. Your dollar would go only half as far. So you should invest your money in something that has a good chance of outpacing inflation.

I have good friends who make a lot of money and don’t invest it because they are afraid they’ll lose it. Don’t let fear paralyze you. Let fear kick you into action. Warren Buffett, the most successful investor of his time, advises most people to invest in an index fund, which is a fund that represents the overall stock market. Investing in individual stocks is much more risky because it’s hard to tell which ones will go up or down and when they will go up and down but the stock market as a whole has tended to go up over long periods of time, and you should be investing some of your money with a long period of time in mind. I read an article that showed that even if you timed your purchases terribly, buying at the peak of the market just before a crash, then you would still do better than sitting in cash and not investing over the long term. Historically, the stock market gives better returns on investments than other things, like real estate. Whatever you invest in, become familiar with the mechanics of how things work so that you know what to expect and you choose a wise investment.

Investing isn’t just a way to escape the effects inflation. It’s a great way to make money. Investing $100 and waiting a year to make $7 might not sound that exciting at first but it gets a lot more exciting when you have $10,000 saved up and invested and you make $700 a year just by waiting. The other thing that happens is that over time, you benefit from compound interest, which is when your interest makes you money. Initially, your savings of $10,000 makes you money—the $700—but then after another year, that $700 will be making you money too. When you reinvest the return on your original investment, the interest makes interest. So after 2 years of investing $10,000 at a 7% return rate, you don’t have just $10,000 plus 2 chunks of $700 ($11,400)—you have $10,000, 2 chunks of $700, and 1 chunk of $49 (which is 7% of the $700). You have $11,449. If I’ve lost you or bored you or if you’re not that excited about the extra $49, don’t worry. Once you earn money the other ways, you’ll come back and see how exciting this way is, because it’s passive and doesn’t demand any of your time or energy. You just need some money and some patience.

Find ways to make passive income.

It would be nice to make money without doing anything, wouldn’t it? But the world doesn’t really work that way. Money doesn’t grow on trees and no one’s going to give you anything for free. That said, there are ways to make money doing very little. It’s all about giving something of value. When you invest your money in the stock market, you give those companies your money and they use it to make more money. In return for using your money, they aim to give you back more money than you put in. There are many other ways to make money passively. If you write a book, you can write it once and sell it more than once. Writing is a way to work once and get paid more than once. I once rented out my car and made $210 during a week when I wasn’t going to be using it anyway and that was a way to make money by doing very little. What you’ll discover, though, is that most things are more difficult than you think or require more effort than you think. That said, it’s worth it to look at the possible ways that you could make money through the lens of how much time and effort and time it would take you to make that money. Maybe there’s a second or third way that you can make money on the side that takes very little time and adds a little extra to the income from your 9-to-5 job.

How to Save Money

Save part of your income.

The only way that you’ll ever be able to retire early, buy the fancy whatchamacallit that you want, or go on the grand trip that you want to go on, is to save some money. How much should you save? As much as you can. If you saved 90% of your income, you could retire in 2.7 years. If you saved 50% of your income, you could retire in 16.6 years. If you saved 30% of your income, you could retire in 28 years, and if you saved 10% of your income, the could retire in 51.4 years. (A website called networthify.com did this math for me.) Save whatever you can and don’t be discouraged if it’s not that much in the beginning. Any money that you save will snowball into something bigger eventually. Don’t make the mistake of being so daunted by how long the journey is that you don’t start the journey. After all, you’ve already started the journey towards needing more money at the end of your life when you might not be able to work, whether you like it or not. So plan to arrive in style.

Spend less than you earn.

You can save money only if you’re spending less than you’re bringing in. Don’t spend money that you don’t have. Use a credit card for convenience only, not for credit. Work for what you want and be patient in buying it. Figure out how to do without and in many cases you’ll find that you’ll be just fine without whatever it was that you wanted to buy and thought you needed.

Avoid debt.

With investments, you put $100 in, come back later and find that you now have $120, without having done much at all yourself. With debt, it’s just the opposite. With debts, you take out $100 and find that a short time later you have to pay back $120 instead of just $100. For the most part, you should avoid debt. It’s usually the opposite of saving. There are some exceptions. One kind of debt that can be worth taking on is when you have good reason to believe that whatever you buy that causes you to go into debt will help you pay back the debt and make you money that you wouldn’t have been able to make otherwise. For example, going into debt by taking out a loan to go to medical school could be a good idea because once you are a doctor, your salary will help you pay off your debt and make you more money after your student loan is repaid. Going next into debt for an advanced degree in philosophy is not as good of an idea because philosophers are paid less than doctors.

The other time that it might be a good idea to have some debt is when you have the money but you can do something else better with it. For example, let’s say you had a million dollars and you wanted to buy a million-dollar house. You could pay all cash and have no debt, or you could pay a down payment and take out a loan for the rest of the cost. The loan you take out will have to be paid back at a certain interest rate—let’s say it’s 4%. If you can make more than 4% by investing your money somewhere else other than this house, then you shouldn’t pay all cash, you should take out a loan. Since the stock market has historically returned about 7% per year on investments, you could invest your money there and make a 7% return on it, while you pay off your loan at a rate of only 4%. Then you’d be making 3% on your money instead of 0%.

I did something like this the other day. I bought a mattress that was about $2,000 and they offered interest-free financing. That sounded to me like a 0% loan and that’s exactly what it was. So I said yes to that because now although I owe them a large fraction of the $2,000 because I’m paying only $40 a month towards the purchase, I’m free to invest whatever money is still in my pocket, which initially is a large portion of that $2,000. They let me pay it off over 4 years, so after the first year, I have only paid them $500 and I still have $1,500. If I invested that $1,500 in the stock market for that year and received a 7% return on my investment, then I made $105 by taking on this debt and investing the money elsewhere. It sounds a little too good to be true, doesn’t it? Why would they offer a 0% loan? I figured it was because by doing so they would attract buyers who couldn’t afford to spend $2,000 in one day.

Shop around.

You can save a lot of money by shopping around. Different stores sell the exact same product for different prices. You can buy the generic version of the product for less and often it’s adequately good. Generic drugs at the drugstore tend to be exactly as good as their brand name counterparts because they have all of the same active ingredients and the patent that grants the patent holder the right to sell the drug exclusively has expired if you see a generic version of the drug also for sale.

Know what you’re paying for.

As you shop around, try to be aware of what it is that you’re paying for. A bag of chips at the airport will cost more than outside the airport because the shop owners know that you probably don’t have time to leave the airport and it’s not worth the trouble and time of leaving the airport to seek out a bag of chips that’s a dollar cheaper. So in that case you are paying for chips and convenience. If you can plan ahead, you could bring your own chips to the airport. Going out of business sales are usually pretty good because the business owner isn’t trying to maximize their profit anymore, they’re just trying to not be stuck with a bunch of inventory that they don’t have a need for anymore. There, you can get some deals. If they still have your size left.

Consider your options.

As with most things, there’s almost always another option when it comes to matters of money. I have a friend who used to not buy a parking permit at college because the parking attendants didn’t check that often. He would get parking tickets every so often but paying those parking tickets was less expensive than buying a parking permit for the year, so he figured he came out ahead.

Do the math.

Math can be intimidating and stressful for some people but it’s a tool just like money so try to make it work for you. Hammers aren’t for hitting yourself on the thumb, they’re for building houses. The only math you’ll need for saving money and building up wealth is addition, subtraction, multiplication, and division. Hopefully none of them is too scary.

The other day I was waiting in line at the burger joint In-N-Out and I decided to do the math of the Combo #1 option. It’s a burger, fries, and a medium sized drink. This is probably what I would order on my own, except for the medium sized drink. They have free refills, so I’d probably order a small drink and get a refill if I needed one. Well, after I did the math, it turns out that you don’t save any money by ordering those items together as a combo and if you order a small drink instead of a medium drink, then it costs 10 cents less. And I get to drink the same amount of soda because it’s free refills. It was sort of a lot of thought to expend to save 10 cents but as my Irish friend used to say, “If you watch the pennies, then the pounds will take care of themselves.”

Know the rules.

There are often a lot of rules around money and it behooves you to be aware of them. If your bank is charging you a monthly fee to have an account with them, you might be able to avoid that be maintaining a minimum balance or having your paychecks deposited directly into that account.

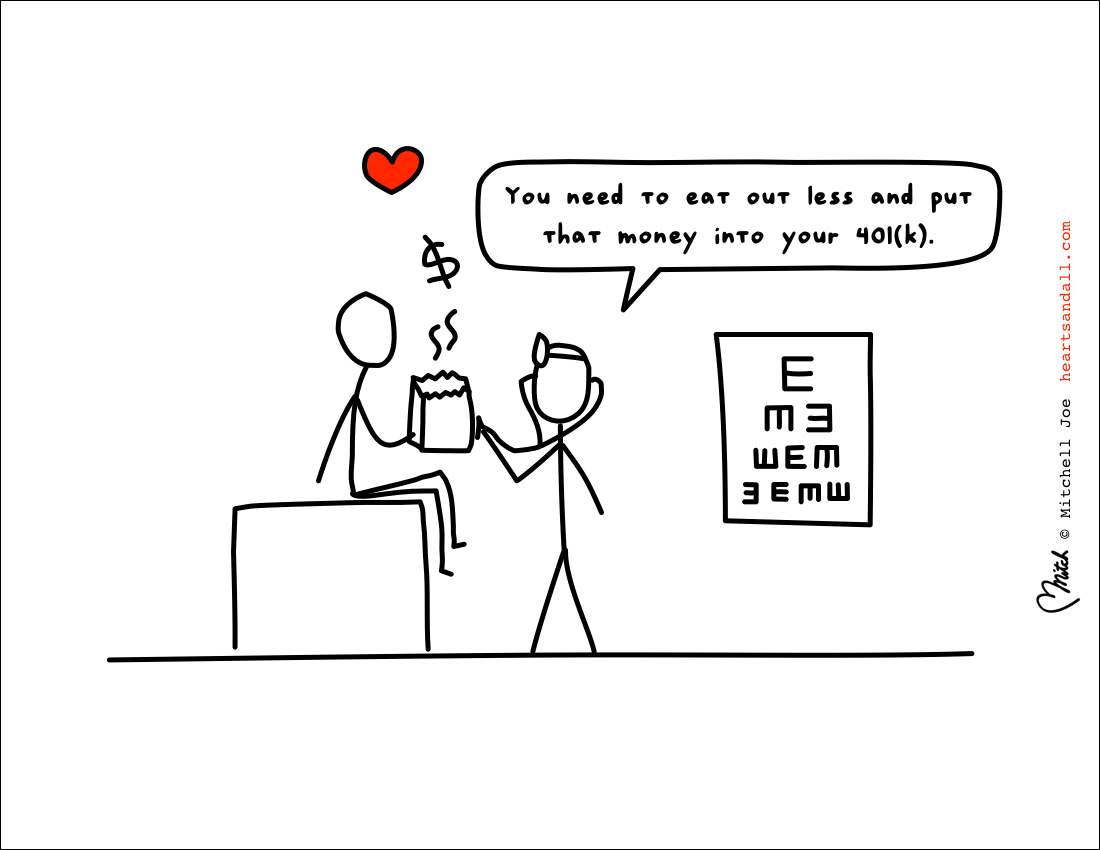

One set of rules that’s worth knowing is around income tax and retirement accounts. One way to save money is to get paid, get taxed, and then save some money. Another way to save money is to get paid, not get taxed, and then save some money. The second way is better. To encourage people to save for retirement, the IRS lets you save a certain amount for your income with pre-tax dollars, meaning that they don’t get taxed as income if you put them into a retirement account. They get taxed when you take them out of the retirement account, but so will any savings you have in a non-retirement account.

If this is boring you, that’s okay. Come back and read it after you’ve worked for a while and when you’re interested in retiring early.

The good thing about most of the important rules relevant to saving and retiring is that they don’t change in major ways too often. So after you learn them once, you don’t have to spend too much additional time learning more rules.

Do it yourself.

If you have more free time than you have spare money, then you should do things yourself. Mow your own lawn, iron your own shirts, wash your own car, etc. You’ll save money, learn a lot more than when other people do it for you, and you’ll be able to take that learning with you to other parts of your life.

Cook your own meals.

The difference in cost between eating out and eating in is huge. It costs about 10 times as much to have fried eggs and toast from a restaurant than it does at home and it’s really easy to fry eggs and toast bread. I’m sure you’ll want to eat out sometimes but on the days when you don’t think you’ll enjoy it 10 times as much, eat at home. It’s much healthier and you’ll probably find that you enjoy cooking.

Buy less food.

You can probably save money by buying less food. I don’t mean that you should ever go hungry. I just mean that if you’ve ever thrown away food because it went bad before you had the chance to eat it, then that was food that you didn’t need to buy. Whenever I throw away food like that, I feel like I’m throwing away money. One trick you can try is to put a few things back from your shopping basket while you’re still at the store and haven’t paid for anything yet. If you tend to throw away food that goes bad, then that means you tend to overbuy at the supermarket.

How to Spend Money

Buy only what you need.

If you haven’t found a job that you love enough to do for free on a Saturday, then work will feel like work. It will feel like something that you are doing for the money. The hours that you give up to go to work in order to make money are more precious the less you like your job. You should treat the dollars that leave your wallet as just as precious, because that’s where they came from. Is buying that T-shirt worth working for one hour to have? Maybe it is and maybe it isn’t. But that’s how you should be thinking about it. Sometimes when I go out for dinner, I order the least expensive meal on the menu because I may not be going out to have a nice meal, I may be going out mostly to get out of the house and have someone else cook for me. Both of those things can be had with the least expensive meal on the menu just as much as they are had with the most expensive meal on the menu.

Spend money on things that bring you joy.

It’s certainly okay to spend money. That’s what it’s for. If you can afford to buy a pair of $100 shoes and you think that they will bring you $100 worth of joy, then go for it. It’s your money. Just balance this against your savings goals.

Don’t increase your spending just because you start to make more money.

When you get a raise, it can be tempting to start spending more money because you now have more money. This is a bit of a trap. If you didn’t need it enough to buy it before, then you probably don’t need it any more now that you have more money. You might treat yourself to something that you’ve been wanting to buy but an increase in pay is not a reason to spend more—it’s a reason to save more. And even treating yourself to something is a little bit strange—it’s a little bit strange to celebrate having more money by parting with some money. You could just do a happy dance. Those are free.

Keep money in the right perspective.

Money is not the most important thing in life.

I didn’t mean for this to be the longest chapter in the book. Its length doesn’t represent its importance; it represents the amount of nuance there is with money. Money is not the most important thing in life. Your physical health and safety, your relationships with your friends and family, your passion projects, your contribution to humanity, and simply enjoying your life—those are the most important things in life.

You might have enough money to enjoy your life as much as a millionaire even if you’re not a millionaire yet.

The value of money has diminishing returns. Someone who has $20 million isn’t twice as happy as someone who has $10 million. Having an extra $100 in your pocket means more to you the less money you have. They’ve done studies and, after a certain point, there’s not a significant difference between how happy you are and how much you enjoy your life. Millionaires might have cable TV but non-millionaires can buy and enjoy cable TV just as well, if that’s what they’re into. The amount of annual income you have to have for this parity is surprisingly low. In 2010, it was about $75,000, meaning that people who made $100,000 or $200,000 per year weren’t significantly happier than people who made $75,000 per year. So that’s good news.

Choose a job that you enjoy.

Working just for money can get old real fast. Living for the nights and weekends and dreading work isn’t a fun way to live. So choose a job that you enjoy. That will make your days more enjoyable. There’s a saying: “Find something you love to do and you’ll never have to work a day in your life.” And there’s a lot of truth to that. If you find something you love to do and you get paid well enough for it, you might feel like you’re financially independent way before you actually are. I hope you find that. It’s worth noting that many of the people who can afford to stop working—Warren Buffett, Jeff Bezos, Elon Musk—are still working. If you find a job that you love so much that you would do it for free, then you will feel like you’re financially independent long before you actually are. And, if you find a job that you love, you’re more likely to become very good at what you do and your goods or services are more likely to become highly valued by other people.

Stop building up wealth as soon as you don’t need to anymore.

If you don’t find a job you love, then remember to stop building up wealth as soon as you don’t need to anymore. There’s no reason to work until 65 if you don’t enjoy your job and you don’t have to work. When you spend so much of your life working, it can be hard to remember why you’re doing it and when you should stop. If you have enough money for whatever it is that you need money for, then remember why you started to make money and realize when you could and should stop. Go to the beach!

Remember that money is a tool.

I don’t particularly enjoy thinking about money but I appreciate what it does for me and what it can do for me. It makes trading goods and services much more efficient. If I have an apple tree and want bananas and you have a banana tree but don’t want any apples, well, this is when money comes in handy. Its stored value also makes it possible to retire early, which I’m interested in. A polar bear can hibernate for only one winter before it needs to eat again and a squirrel generally can’t store up enough nuts to last a lifetime because the nuts will go bad too quickly. But a human could store up enough money to pay for the meals for the rest of her life, and that’s interesting. We can also invest our money to make more money. Squirrels can’t do that with nuts. So money is a nice tool. Nothing more, nothing less. Use it well.

I hope you enjoyed reading the first 20 chapters! The next 5 chapters will be available for subscribers only and you can subscribe for free below. Thanks for reading!

Like it? Share it. Thanks!